Acquiring Benchmarking Skills for Beginning and Progressing Farmers and Ranchers

View the complete report online.

This project addressed the financial and production risks of beginning and progressing farmers and ranchers in south central Utah. Through workshops and monthly one-on-one instructions, participants 1) identified the cost and profit centers of their businesses, 2) used QuickBooks classes to assign financial transactions to their identified cost and profit centers, and 3) identified useful benchmarks within their cost and profit centers for comparison to industry enterprise benchmarks:

- Management accounting practices,

- Knowledge and risk management skills,

- Ripple effects mapping,

- Development of a strategic operating plan, and

- Increased ability to manage risk.

The emphasis was on:

- Implementing management accounting practices by identifying cost and profit centers.

- Developing improved management knowledge and risk management skills by focusing on Management Accounting.

- Utilizing management accounting principles to evaluate costs of production and analyze businesses through comparison to industry benchmarks.

- Coupling analysis to development of a strategic operating plan that increases the producer’s ability to manage risk.

Following the Project

All of the participating farmers improved their record keeping skills, many showing significant improvement, noted by their financial lenders. The 24 participants who completed the full FINAN analysis reduced much of their financial and production risk as well as improved their management abilities, (21 of the 24 were included in the 2015 Utah College’s Farm/Ranch Management Annual Report.).

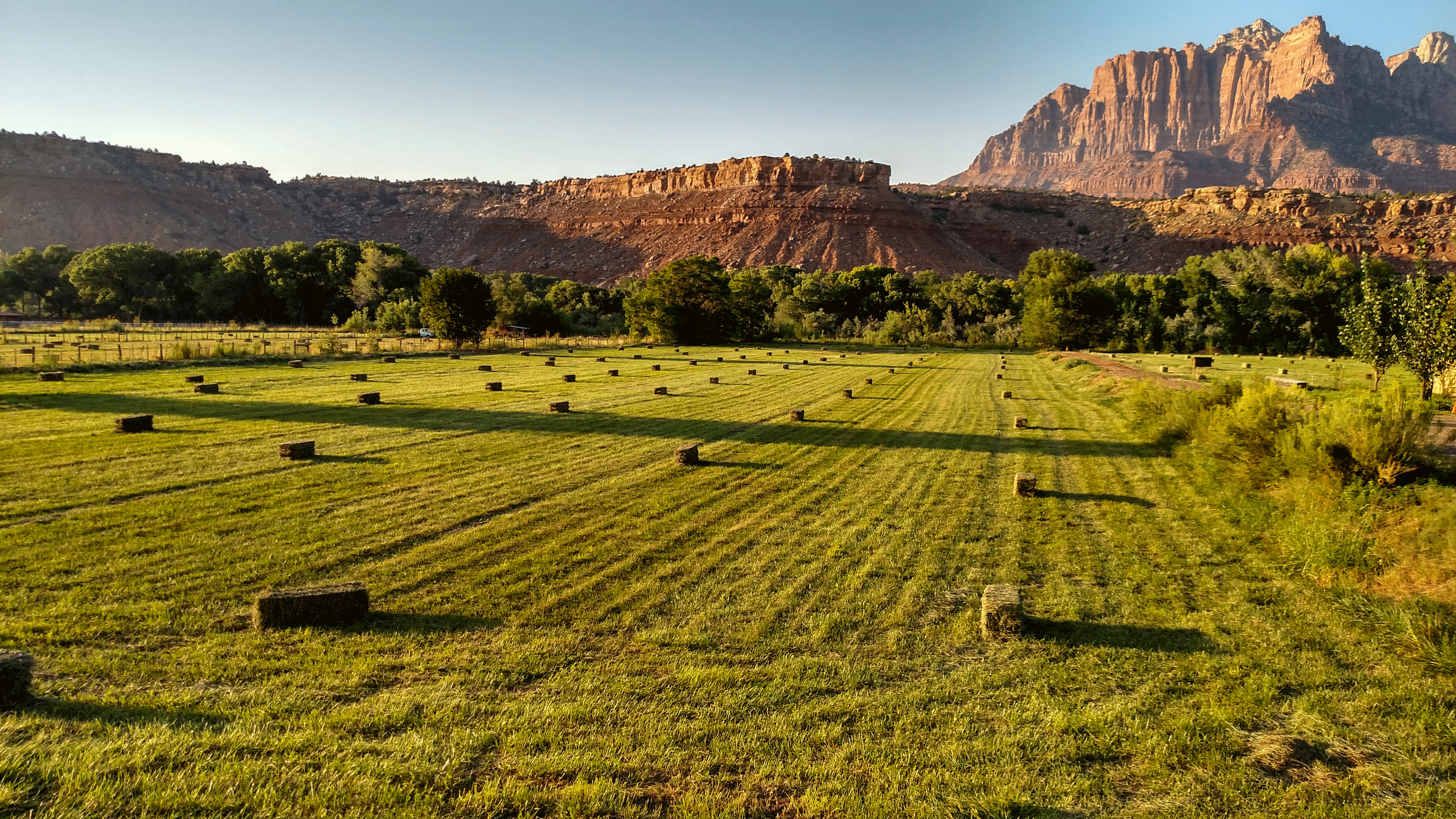

The opportunity to do “Ripple Effect Mapping” as a measure of the many and varied outcomes that rippled out from the project, brought forward impacts otherwise unrecognized by the project delivery team and the participants alike. For example: One participant who had the most “ripples” also is the most open to talking about the change in his family, particularly his father in-law’s paradigm change and the change in his farm/ranching operation. Additional areas of risk addressed by the farm included: 1) Production Risk, beginning a grass-fed, direct-marketing beef enterprise. The producer’s wife has a marketing degree and feels more a part of the business, using her talents and abilities. 2) Marketing Risk, the producer focused on marketing replacement heifers rather than weaned calves, and custom grazing rather than harvesting and selling forages. 3) Human Risk, the family relationships have improved through increased family time, resulting from grazing and not spending as much time feeding hay. In addition, they have seen success with winter grazing, bringing his father in-law to support grazing rather than feeding for those four or five months.

Success Stories

Project Details

Jay Olsen

Snow College

Project Director

2015

Funding Year

220

Participants

Project Results

35

Participants identify their cost

and

profit centers

(farm business enterprises).

32

Participants gained skills to

accurately assign

expenses

and revenues to the

appropriate

cost/profit center.

27

Participants developed potential

solutions that

address their

cost/profit center benchmark

variances and provide

guidance in managing

financial and production risk.

Loan officers from Farm Service Agency, Western AgCredit, and Zions, also collaborators on the grant, have shared, “Our producers who work with the Snow College Farm/Ranch Business Management program have the best records of any of our clients and make better management and marketing decisions.”

West Desert Land and Livestock in Delta has had a lot of success in a number of different production areas. Through their use of both QuickBooks and the year-end report, they were able to complete a full evaluation of their operation and the different enterprises within it. Over the last couple of years, they have gone from a fairly traditional cow calf operation, growing their own hay to feed their animals, to now incorporating their hay production with cover crops, thus reducing their feed costs and machinery needs significantly. Additionally, because of their involvement in cover crops, they are now offering consulting for other farmers and bringing in additional income that way. They are planning to transition from backgrounding their calves in a feedlot to selling the steers at weaning and retaining their heifers on winter cover crop grazing. They will then sell the heifers that they do not retain for their own replacement to other ranchers as replacement heifers, and then butcher the remainder of them and market them at farmers’ markets as grass-fed beef.

“I don’t understand why every producer in the valley isn’t taking advantage of this program. For the minimal cost each year it is a great service to have an extra set of eyes looking over the finances as well as having someone to talk to about different ideas.”

–Project Participant

Educational Materials

View the comprehensive Farm/Ranch Management Report (pdf) – developed used FINPACK and RANKEM software. Additional farm financial report can be queried from the Center for Farm Financial Management FINBIN website.

More from Winter 2017 Newsletter

Introduction

Introduction

Risk management education will play a significant role for America’s farm and ranch families.

Risk management education role »

Program Evaluation

Program Evaluation

Program evaluation is essential to the success of the Extension Risk Management Education (ERME) program.

Essential program evaluation »